With the Federal Reserve rapidly raising interest rates to combat inflation, short-term lending has become very attractive relative to any time in recent history. High-quality municipal yields currently sit at levels not seen in over a decade, while relative valuations have also become more attractive. We believe the current environment offers muni investors an opportunity to lock in attractive rates in a period when the fundamental credit outlook for the asset class remains strong.

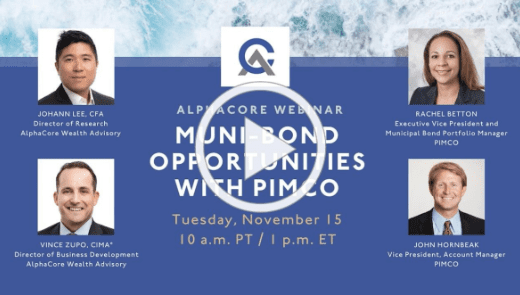

In light of this landscape, AlphaCore Wealth Advisory teamed up with PIMCO Investment Company, a partnered investment manager on our platform and one of the largest fixed-income managers in the world, for a recent webinar. During this webinar, AlphaCore Director of Investment Research Johann Lee and Director of Business Development Vince Zupo had an insightful discussion with Rachel Betton and John Hornbeak from PIMCO’s municipal bond team on the latest updates on municipal funding markets and investment opportunities that have emerged from the recent interest rate volatility.

Some of the specific topics discussed during this webinar include:

- The importance of working with a partner to manage municipal bond allocations

- Where absolute yields have historically been, where they are now and how they got here

- Reasons why the municipal bond market can be an attractive asset class for investors

- The difference in the steepness of the yield curve between corporate and municipal bonds

- What liquidity looks like in the municipal bond market

- Current opportunities in the municipal bond market

- Ways investors can take advantage of these opportunities

- An overview on separately managed accounts and how they compare to mutual funds

- How PIMCO typically structures its portfolios

- When it may make sense for investors to incorporate out-of-state bonds

- How the latest election cycle may impact the municipal bond market

To learn more about this webinar or any of our future events, please do not hesitate to contact us.