2026 Market Outlook: Six Questions for 2026

Markets Exceeded Expectations in 2025

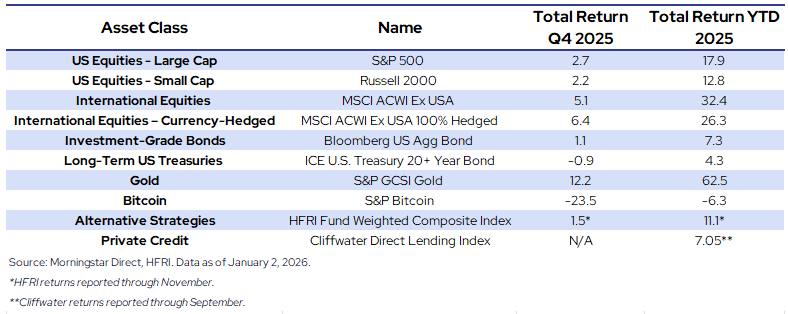

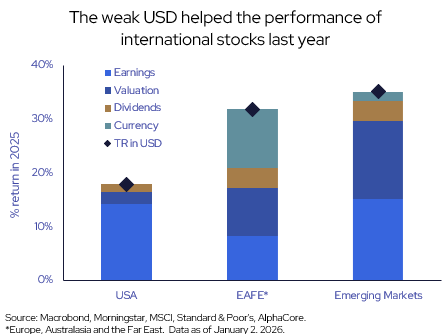

During 2025, traditional asset classes delivered emphatic performance. The S&P 500 delivered a third consecutive year of double-digit returns. The Bloomberg Barclays Aggregate posted its best year since 2020. International stocks had their strongest year in at least a decade—even if you account for the move in the U.S. dollar, which fell in value during the year. Long-term bonds were positive for only the second time since COVID, and gold surged 62.5% after gaining a solid 26.6% in 2024.[1]

If traditional assets had their moment in the sun, then surely alternatives must have been stuck in the shade, right? Wrong. In general, hedge funds have so far notched strong gains, averaging more than 10% through November. During the third quarter, private equity exits increased 18% over the prior year.[2] And despite all the scrutiny aimed its way, private credit’s rate of defaults has stayed very low overall.[3]

So, with all this good news, we must be doomed in 2026… right? Not as far as we can tell. Expert outlooks for 2026 appear consistently upbeat. Economists expect the U.S. to grow at a strong—if moderating—rate of 1.8% next year.[4] Equity analysts are calling for yet another year of double-digit earnings growth in the S&P 500.[5] Even bond investors (typically the fly in the forecasting ointment) are unusually optimistic, energized by high starting yields and easing inflation.

You might be reading all of this and thinking: if things were great this year and they’re expected to be great next year, why isn’t this entire outlook a neat little one-pager? If the story is so straightforward, can’t we just pack up and go home?

Because this is investing, it’s never quite that simple—much as we wish it were so. Forecasts aren’t destiny; more often than not, they miss the mark. Beneath the smooth surface of 2025’s results run deep currents that are reshaping not just our portfolios, but more broadly, our world.

Investors describe today’s economy as “K-shaped,” where some people were able to weather the COVID downturn and inflation spike and bounce back financially, while others have been stuck in a rut, unable to catch up. That’s why many peoples’ lived experience of 2025 didn’t feel nearly as rosy as the headline numbers imply, and that disconnect matters. These are the thorny questions you ask us about most often—the very questions that keep our team up at night. This quarter, we’re taking a different approach. Rather than narrate the year that was, we’re tackling the six biggest questions we think will matter most in 2026, and what they could mean for your portfolios.

There is no guarantee that any investment strategy, investment recommendations or decisions will achieve its objectives, generate profits or avoid losses. Past performance is not indicative of future results. The commentary may utilize index returns; however, you cannot invest directly into an index without incurring fees and expenses of investment in a security or other instrument.

Six Questions on Our Minds for 2026

How long before the artificial intelligence (“AI”) boom runs out of steam?

Artificial intelligence dominated headlines in 2025, fueled by an infrastructure buildout that has taken on the urgency of a modern-day space race. The major tech giants—Meta, Microsoft, Alphabet, and Amazon—collectively are on track to spend nearly $400 billion this year in long-term projects like equipment and data centers, far above earlier estimates of $227 billion.[6],[7] (While not every dollar will go to AI, much of the spending is driven by the scramble to build out AI capabilities and capacity.) Analysts predict these investments will keep climbing: Morgan Stanley now expects total spending by AI-linked tech companies to reach nearly $550 billion in 2026, and approach $900 billion by 2028.[8],[9]

The scale of the expansion is reshaping the way companies are raising cash. Newer players such as OpenAI and CoreWeave don’t have the financial safety nets that big tech firms enjoy, so they’re relying on a complex network of deals where suppliers, customers, and even rivals help fund each other. This tangled web has raised hard questions about whether such rapid growth can last.

For the companies at the center of this transformation, this spending is not optional—it is essential for survival. So, we believe the answer is, yes, the boom could continue. Although this network of relationships may make the system more fragile, the boom will also endure so long as the key players keep producing.

However, we expect markets to be judicious about which companies they reward, as evidenced by the tough run experienced by Oracle in recent weeks.[10]

Source: Bloomberg. Published October 7, 2025. For illustrative purposes only.

Continued production relies on strong profits, and markets expect leading tech firms to deliver. The “Mag 7”—which also includes Tesla, Apple, and Nvidia—is expected to grow earnings by about 19% in 2026.[11] If actual earnings come even close to that estimate, these companies appear well-positioned to handle additional investment costs without putting their financial strength in jeopardy. In fact, history suggests these companies may beat analyst estimates, providing potentially more fuel for spending. While there are risks to watch, the combination of strategic necessity, competitive pressure, and robust earnings power makes it reasonable to expect the AI boom could extend into 2026.

Of course, investing in AI comes with real risks, and because the tech is so new, our level of uncertainty is high. We favor infrastructure as a way to invest in AI, since the U.S. faces a growing need for power that will last well beyond this current cycle – hopefully giving us some protection if things go wrong. Across asset classes, we focus on working with managers who have a history of maintaining strict discipline when reviewing potential investments, ensuring each opportunity fits squarely within their strategy’s strike zone—regardless of its thematic appeal.

Can the U.S. economy continue to grow?

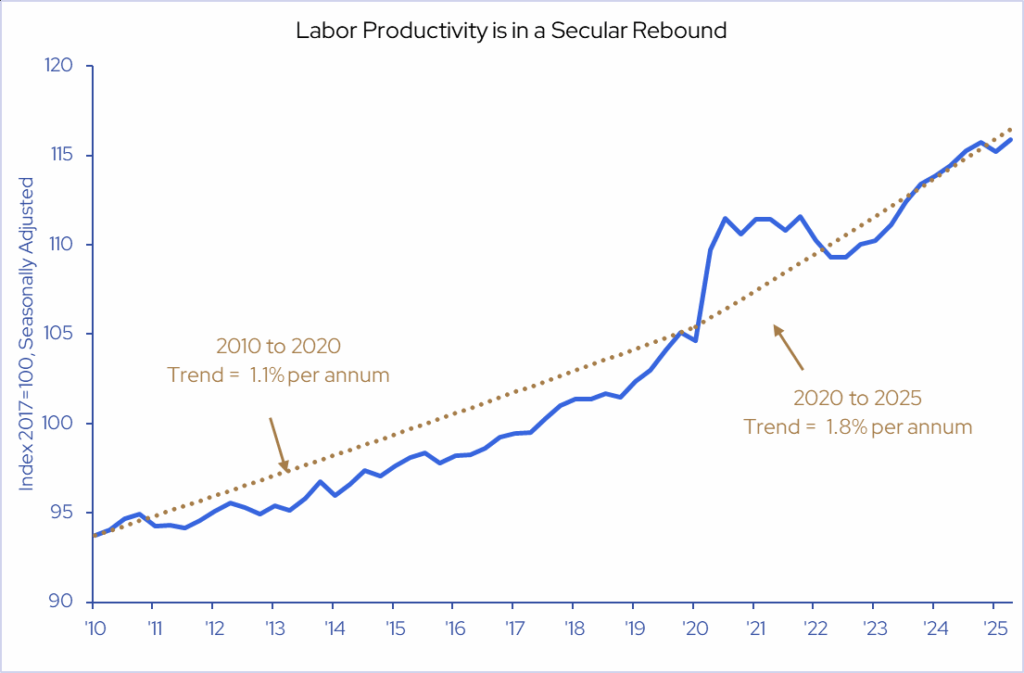

The question of whether AI-related investment can stay this strong—or even accelerate—is central to our outlook for the U.S. economy. It’s hard to overstate how huge the AI wave has already been: by some estimates, it makes up 5% of GDP, similar to the level of software spending during the tech boom.[12] And many economists believe that AI is already making workers more productive, giving fresh legs to a trend that started during the COVID period (see chart).

For illustrative purposes only. Not indicative of past or future productivity.

More broadly, though, it’s fair to say that the current market environment just feels… off. Investors are already assuming that the AI buildout will lead to oversupply at some point; the debate has shifted from if to when. At the same time, the headlines are full of credit-market dustups and fears of rising loan defaults, while consumers are still coping with years of price hikes. With so many pressure points in the system, we understand why it’s easy to think a recession in 2026 is inevitable.

We share many of these concerns—and think about them constantly—but it’s also worth noting that a downturn isn’t the market consensus. As of November, the Bloomberg consensus forecast is calling for 1.8% GDP growth in 2026.[13] Forecasts are never perfect, of course, but 2025 GDP growth could probably land very close to where last year’s predictions placed it at: 1.9%.[14] Whether or not growth actually comes in that strong, the show could absolutely go on.

That said, we do think economic risks have risen, which invites a bit more caution. This means asking our managers if their investments compensate us enough for the risk they’re taking on. We favor strategies with tight and consistent risk controls, backed by solid assets—places where discipline shows up in outcomes. We’re watching our credit managers closely to make sure that no one is stretching for yield. A mature economic environment doesn’t automatically mean the end is nigh; for our managers, it means that the margin for error has narrowed, and thoughtful positioning matters now more than ever.

Will the Fed keep cutting rates into 2026?

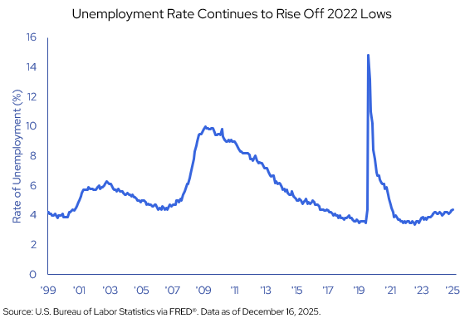

As U.S. large-cap equity markets were buoyed by enthusiasm around AI-related capital expenditures, more cyclical and rate-sensitive segments of the economy struggled under the late-cycle conditions we discussed above. In 2025, the Russell 2000 lagged the S&P 500 by more than five percentage points.[15] As pressure has mounted on smaller and more cyclical firms, unemployment has risen and job gains have slowed.

Responding to these pockets of weakness, the Federal Reserve has already cut interest rates three times since September. The committee seems reluctant to ease further without additional evidence of material weakness in the economy and labor market (especially the unemployment rate, as shown in the chart nearby). [16]Even so, given current trends, markets have begun to price in additional cuts before Chairman Powell’s term ends in May. After that, we’ll just have to see.

For illustrative purposes only. Past performance is not indicative of future results.

How might lower policy rates affect the economy? Historically, rate cuts generally provide a tailwind for the more rate-sensitive parts of the market that we just discussed, notably small and mid‑cap companies. Lower borrowing costs on the margin may help fuel the continued recovery in M&A and transaction activity across equity markets witnessed in 2025, which saw the dollar amount of transactions rise without the number of IPOs surging. We expect a further recovery in 2026 which would be a welcome development for private equity funds who have been constrained by a sluggish deal environment.

Within fixed income, high-credit quality bonds such as U.S. Treasuries have contributed nicely this cutting cycle and appear broadly fair to fully priced at current levels. This dynamic limits the margin of safety for taking any meaningful interest rate risk. With that view in mind, we have given our fixed income managers wide latitude to take active positions across the yield curve, granting them the ability to trade around potential interest rate volatility and dislocations across sectors. Given high starting yields in other segments of the bond market such as mortgage-backed securities and convertible bonds, our current environment should continue to provide ample relative value opportunities that a skilled investment team can seek to harvest.

Away from Wall Street, it really matters how longer-term interest rates react to cuts from the Fed from here, as mortgages and other financing of commercial real estate are priced off those longer-term bond yields. If yields fall alongside policy rates, sectors such as housing could see meaningful relief. If they rise instead—because investors anticipate renewed inflation or demand more compensation for a perceived higher risk of default in U.S. debt—the consequences would be far less favorable. The risk of the latter outcome, particularly in the presence of still-loose fiscal policy, cannot be ruled out. More on that below.

Will investors start to care about the U.S. budget deficit in 2026?

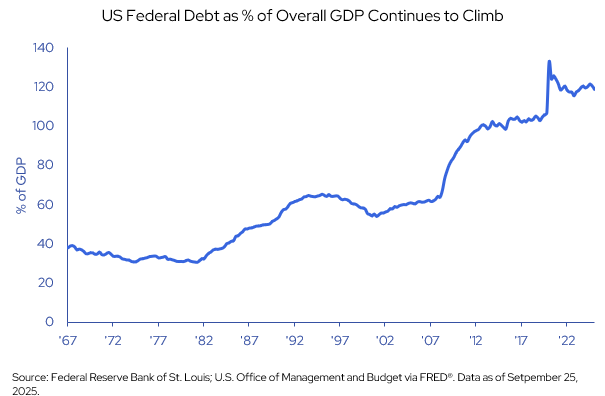

On balance, we don’t think so. With that said, the ramp up in spending by Washington since 2020 certainly has us on close watch. The U.S. Treasury continues to finance persistent federal budget deficits, with total gross national debt of over $38 trillion as of December 2025.[17]

For illustrative purposes only. Past performance is not indicative of future results.

All that debt means our government owes a substantial amount in interest. In 2025, interest on the national debt formally surpassed $1 trillion, becoming one of the largest line-items on the Federal spending budget.[18]

As interest costs rise, a growing portion of tax revenues is devoted to servicing existing debt. Even with interest expenses ballooning, legislators have limited wiggle room to rein in spending in other areas. Today, more than half of federal outlays are directed toward entitlement programs such as Social Security and Medicare/Medicaid, while national defense and net interest each account for low‑ to mid‑teens percentages of total spending.[19] Without commensurate cuts to other services, this line item could crowd out discretionary investment, and catalyze future tax hikes.

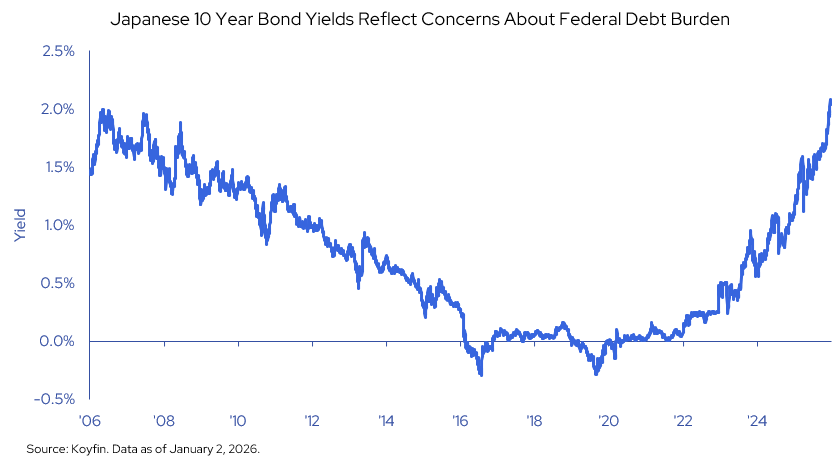

Overseas, it will be important to monitor how other high‑deficit sovereigns manage their fiscal paths and bond markets, as episodes of fiscal stress abroad can spill over into the U.S. Investors can look to Japan as a case study, given that the country has the highest federal debt levels in the developed world.[20] The recent upward pressure on Japanese bond yields is an example of how markets may react to the activities of other central banks: rising inflation and loosening fiscal budgets in Japan have catalyzed a rapid rise in yields in Japan. (As yields rise, bond prices fall, hurting bond investors.)

For illustrative purposes only. Past performance is not indicative of future results.

How to invest against this fiscal backdrop? Every financial situation is different. However, there is a continued case for holding real assets, such as gold, as part of a diversified portfolio. Gold’s performance has been supported by ongoing central bank purchases, strong demand from Chinese investors, and expectations of further monetary easing as central banks respond to softer labor markets and moderating growth. In our view, gold continues to serve as a useful diversifier against potential fiscal mismanagement, negative real rates, and tail‑risk scenarios where confidence in fiat currencies or sovereign creditworthiness is tested. We have several active managers across various asset classes who we think could help stabilize client portfolios if these risks manifest in 2026.

What can markets expect from federal policy in 2026 as America heads to the polls for mid-term elections?

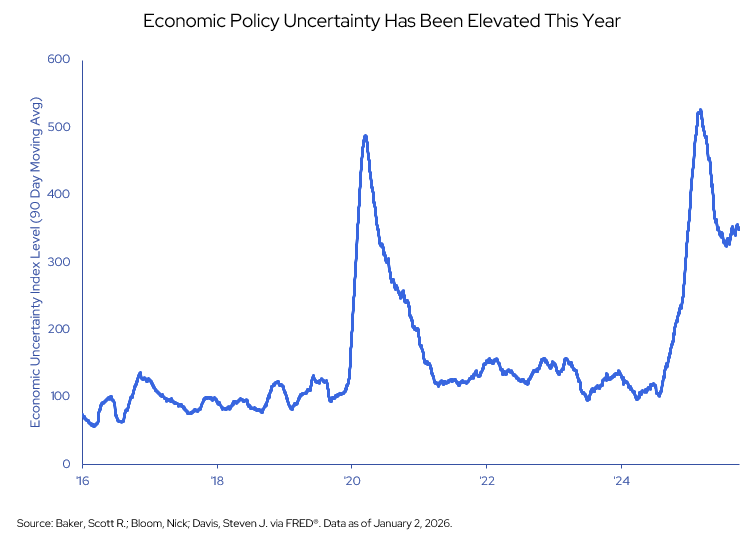

With unified control of the House, Senate, and Presidency, 2025 proved to be an unusually active policy year. Major legislation, including the One Big Beautiful Bill Act, was enacted alongside a high volume of executive actions—at least 225, compared with an average of 269 over a full presidential term—while trade policy, particularly tariffs, emerged as a recurring source of market volatility. [21] As the accompanying chart shows, measures of economic policy uncertainty rose to levels comparable to the early pandemic. Think about that for a moment – by this measure, business leaders expressed having as much difficulty making decisions during the first half of 2025 as they did during a global lockdown.

For illustrative purposes only. Past performance is not indicative of future results.

A major issue looming in early 2026 involves tariffs and the legal basis for their implementation. The Supreme Court is expected to rule on the use of the International Emergency Economic Powers Act to enact tariffs, and the outcome could move markets. However, in the event that the Supreme Court rules against the Trump Administration, we expect the White House will seek to leverage other avenues to enact tariffs on trade partners.

As the weather gets warmer, attention will increasingly turn to the midterm elections, with 22 Republican and 13 Democratic Senators up for re-election. Both parties have taken note of the electoral success achieved by emphasizing affordability in recent races, including high-profile contests in Virginia, New Jersey, and New York City. As a result, campaign rhetoric is likely to focus less on slowing the pace of price increases—otherwise known as inflation— and more on policies that seek to reduce the overall level of prices, otherwise known as deflation.

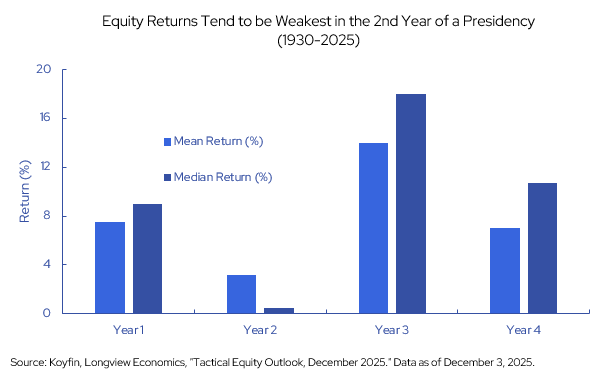

History shows that the second year of presidency usually leads to the weakest set of stock market returns with significant volatility driven by the political cycle (see chart nearby). Even if policy changes are less dramatic than last year, politics is still likely to generate meaningful volatility in liquid markets.

For illustrative purposes only. Past performance is not indicative of future results.

What can we expect from international markets? Will global growth continue to rebound?

International markets had strong performance in 2025. As the nearby chart shows their performance was primarily driven by an increase in valuation and the decline in the U.S. dollar, rather than robust economic improvement.

Instead, countries around the world continued to muddle through with slow growth but low unemployment, whilst further progress was made in moving past the inflationary period of recent years. The majority of central banks around the world have been reducing interest rates, and with energy prices also low, the conditions could be in place for a moderate strengthening of global growth in 2026. Will conditions abroad support further gains in years to come?

We’re encouraged by the ways in which different regions are gradually moving past their specific difficulties. In Asia, although China’s real estate sector remains weak, strength in other areas suggests the risk of systemic crisis in the country has significantly reduced. Despite rising tensions with the U.S., India’s economy continues to boom as a middle class grows, global technology firms continue to invest there, and past infrastructure investments pay dividends. Shifting corporate priorities in Japan are creating new investment options for capital to be put to work.

In the core of Europe, even though both France and Germany grapple with poor competitiveness, other parts of the continent such as Spain and Scandinavia continue to perform well. In addition, the decline in the U.S. dollar this year has put a tailwind behind conditions in a variety of emerging markets.

While it would be a stretch to assume last year’s performance will be typical going forward, valuations remain reasonable, macro weaknesses are gradually being dealt with, and the dollar remains expensive on many measures. Hence, AlphaCore believes that international investing is a key part of long-term wealth management and we continue to examine multiple options of providing clients with exposure to the key themes driving the world economy in both public and private markets.

For illustrative purposes only. There is no guarantee that any investment strategy, investment recommendations or decisions will achieve its objectives, generate profits or avoid losses. Past performance is not indicative of future results.

In Conclusion

For 2026, we expect continued growth in the U.S. economy and a modest acceleration abroad. Under the headline numbers, we foresee several powerful themes continuing to drive investment returns. In addition to an ongoing wave of AI-driven investment, these themes include continued shortages across energy and commodities pushing up prices and spurring projects to bring on new supply. At the same time, rising global tensions and growing government debt may also continue to erode confidence in developed economies.

We acknowledge there are risks on both sides of our view –to the downside as well as the upside. A weaker job market could slow the economy and cause stocks to slump, or accelerating inflation could rattle bond markets. It’s also equally possible that the S&P could have another good year and bond yields could end the year lower than where they start, as inflation drifts downwards and central banks continue to reduce policy rates. Although this would feel good for those invested in a 60/40, it would also show us that stocks and bonds still move together, which is not how these two asset classes behaved in the 2010s. What rises together can very easily fall together, especially when starting from lofty valuations.

Our core investment belief is to use every tool available across both public and private markets, across both traditional and alternative investments, to prepare portfolios for any outcome. Partly we do this with the goal of protecting against stock market swings. Yet even if we knew stocks would perform well, we would still invest across a wide swathe of assets as we seek to capture multiple dimensions of the powerful themes that are driving the economy. In short, we think there are more ways to guide your investments, and we look forward to pursuing them in 2026 and beyond.

As always, don’t hesitate to reach out if you have any questions.

Commentary Contributors

Eric Gerster, CFA®

Chief Investment Strategist

Johann Lee, CFA®

Director of Research

Edward J. Durica, III, CFA®

Senior Wealth Advisor

Madeline Hume, CFA®

Senior Research Analyst

Dr. David Stubbs

Chief Investment Strategist

Sources

[1] Source: Morningstar Direct. Data as of November 30, 2025.

[2] Source: Pitchbook. “US PE Breakdown, Q3 2025.” Published October 9, 2025.

[3] Source: Cliffwater. “Cliffwater Direct Lending Index Q3 2025 Report.” Published December 5, 2025.

[4] Source: Goldman Sachs. “The Outlook for Fed Rate Cuts in 2026.” Published December 3, 2025.

[5] Source: Factset Earnings Insight. Data as of December 19, 2025.

[6] Winkler, Rolfe, Rattner, Nate, and Hererra, Sebastian. “Big Tech’s $400 Billion AI Spending Spree Just Got Wall Street’s Blessing.” Wall Street Journal. July 31, 2025.

[7] Source: Bloomberg Intelligence via BlackRock. Data as of September 8, 2024.

[8] Source: Leswing, Kif. “OpenAI’s spending bonanza has Wall Street focused on capex in Big Tech earnings reports.” CNBC. October 27, 2025.

[9] Source: Ren, Shuli. “AI Data Centers Give Private Credit Its Mojo Back.” Bloomberg. October 2, 2025.

[10] Source: Hererra, Sebastian. “Oracle Shares Tumble as AI Spending Outruns Returns.” Wall Street Journal. December 10, 2025.

[11] Source: Factset Earnings Insight. Data as of November 21, 2025.

[12] Source: KKR. “Beyond the Bubble: Why We Think AI Infrastructure Will Compound Long after the Hype.” Published November 2025.

[13] Source: Goldman Sachs. “The Outlook for Fed Rate Cuts in 2026.” Published December 3, 2025.

[14] Source: Federal Reserve Bank of Philadelphia. “Fourth Quarter 2025 Survey of Professional Forecasters.” Published November 17, 2025.

[15] Source: Morningstar Direct. Data as of January 2, 2025.

[16] Source: US Federal Reserve, Federal Reserve Board – Federal Reserve issues FOMC statement. Published December 10, 2025

[17] Source: U.S. Department of the Treasury, Bureau of the Fiscal Service. “Debt to the Penny.” Data as of December 30, 2025

[18] Source: U.S. Treasury Department. “Interest Expense and Average Interest Rates on the National Debt FY 2010 – FYTD 2026.” Data as of November 30, 2025.

[19] Source: Peter G. Peterson Foundation, “Chart Pack: The U.S. Budget.” Data as of August 2025.

[20] Source: International Monetary Fund. “General Government Debt 1950-2024.” Data as of September 2025.

[21] Source: The American Presidency Project. “Executive Orders: Washington – Trump II.” Data as of December 20, 2025.

Disclosure:

This material is being provided for informational purposes only. This material represents the current views and opinions of AlphaCore Capital, and there is no guarantee that any opinions will prove to be accurate, or any forecasts made will come to pass. No obligation is undertaken to update any information, data or material contained herein. AlphaCore provides investment advice only within the context of our written advisory agreement with each AlphaCore client. It may contain forward-looking statements regarding economic trends, market developments, or other factors. Actual results could differ materially from those expressed or implied. AlphaCore is not recommending the purchase, sale or holding of any security. Information provided does not constitute an offer or solicitation, and should not be considered tax, legal, or accounting advice.

There is no guarantee that any investment strategy, investment recommendations or decisions will achieve its objectives, generate profits or avoid losses. Past performance is not indicative of future results. Certain data, charts, or information contained herein are sourced from third parties and are believed to be reliable; however, we do not guarantee their accuracy or completeness. Investors should consider their own circumstances and consult a professional advisor before making investment decisions. All investments are subject to a degree of risk. Risks can include, but are not limited to, increased market volatility, reduced liquidity, or loss of value, including initial invested capital. Alternative investments and strategies are subject to a set of unique risks Gold and other precious metals may be referred to as a “safe haven” investment or generally presented as a safety asset. These references should not be construed to ensure or guarantee any form of investment safety. Any specific security or strategy is subject to a unique due diligence process, and not all diligence is executed in the same manner. No level of due diligence mitigates all risks, and does not guarantee the elimination of market risk, failure, default, or fraud.

Before embarking on any investment program, you should carefully consider the risks and suitability of a strategy based on your own investment objectives and financial position.