Invest in Women, Invest in the Future

At AlphaCore, we aim to help our clients gain the confidence they need to be great investors. This month, we celebrate the women who are taking charge of their financial futures.

Women control over one-third of U.S. household financial assets, with projections indicating significant growth in the coming years. By 2030, women are projected to oversee $30 trillion in household financial assets, a shift driven by a few key factors, including an increase in workforce participation and the ongoing transfer of wealth from the baby boomer generation (of which women make up the largest group of beneficiaries).1

As more women across generations take control of their family’s portfolios, research highlights some key financial considerations that may disproportionately impact women. In honor of Women’s History Month, we’re reflecting on the current state of women and wealth—while sharing a quick reminder about our team’s commitment to uplift female advisors and investors everywhere.

Key Considerations for Female Investors

Investing is not easy, regardless of gender. In isolation, market volatility, liquidity management, and longevity risk are all difficult problems to solve—let alone together! However, in addition to these significant complications, we have observed (and others have documented) three rather unique hurdles women tend to face while growing and managing wealth. As we talk through these three considerations below, keep in mind these are general observations and findings. At the end of the day, everyone’s experience and investing styles are different.

#1: Women Perceive Risk Differently

It is often suggested that women may approach investment risk differently, with a greater focus on long-term goals and diversification.

Studies suggest that female investors tend to have more uncertainty about their income and wealth outside of their investments. People with greater uncertainty about their future financial picture tend to exhibit a lower risk tolerance, and this effect generally explains the gender gap.2 And on the flipside, women demonstrate a higher ability to stomach market risk during periods of turbulence. Around 23% of women withdraw assets during financial downturns, compared to 28% of men.3

Part of this ability to stay the course may be because women are generally more likely to seek out a goals-based investment rather than allocate based on a specific return target, which leads them to invest in well-diversified portfolios tailored to a specific objective. Whether they’re leveraging target-date funds or customized strategies built with an advisor, taking a more thoughtful, goal-focused approach lends itself well to sticking with a long-term strategy.

Another interesting find? Men traded 45% more frequently than women investors on average. This is an important distinction to consider, as more trades can lead to an increase in fees, volatility, and tax consequences—all of which can erode returns over time, as compared to a more strategic investment approach.4

#2: Women May Feel Less Financially Confident—But They Shouldn’t!

Some studies indicate that women may seek additional reassurance in investment decisions, even though research shows their investing outcomes are comparable to men’s.

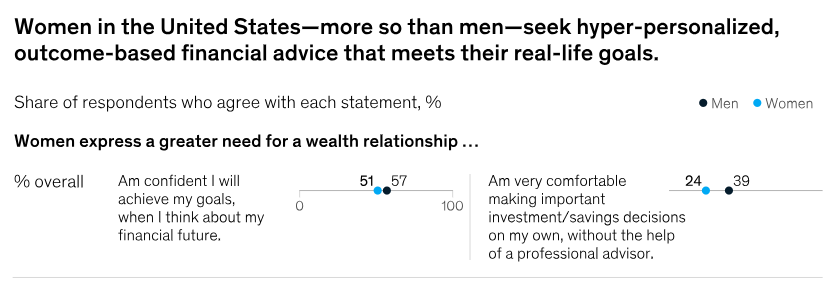

Only 28% of affluent women feel comfortable making investment decisions on their own—about 11% lower than their male counterparts.5 A lack of confidence in their investment abilities can lead women to potentially leave wealth-building opportunities on the table. Or, in perhaps the worst case, lead them to retreat from important conversations surrounding their future and the future of their close relatives.

Part of the reason why this statistic is so disappointing is because women are capable investors. Research has shown time and time again that there is no discernible difference between the performance of male and female investors in a professional setting.6

Education, empowerment, and working with a trusted financial partner matter. Feeling more financially confident doesn’t mean you have to know everything. Rather, knowing you have the right strategies in place and the right advisor supporting you along your wealth journey. At AlphaCore, for example, we prioritize strategic goal-based planning that involves both partners in a household so all our clients can move forward with clarity and confidence

#3: Women are More Likely to Outlive Their Partners

Addressing this confidence gap is important, as many women will take an active role in managing their finances over time. Women tend to marry someone older and live longer than their spouses (by about five years).7 With an increased likelihood of experiencing widowhood, investing and preparing for a long life is critical.

As the great wealth transfer continues, women will become beneficiaries of their spouses’ or parents’ wealth—meaning they will soon have more influence over financial decisions than ever before.

Women need to prepare for this wealth transfer, as well as the possibility of a long life in retirement. Whether it’s a long-term care strategy, a robust emergency fund, or a diversified portfolio built to weather any storm, there are steps we can take to think ahead and prepare for the unexpected.

How AlphaCore Empowers Women Investors

Did you know that women are more likely than men to seek financial guidance from an advisor?8 At AlphaCore, we take a process-driven, goals-based approach to wealth management that we believe enables all our clients—men and women of all ages and life stages—to most effectively work toward their greater goals.

Clarity and strategic planning can play a key role in helping investors make informed financial decisions, which can be especially valuable in addressing the unique considerations of female investors. We strive to create meaningful financial conversations, equipping female partners with the insights and resources they need to make informed decisions that support their lives today and their goals for the future.

Whether you’re investing for your retirement, working hard to establish lasting generational wealth, or preparing for life’s transitions, we’re here to help you navigate the journey with confidence.

Feel free to schedule time with our team today to learn more.

IMPORTANT INFORMATION

This material is being provided for informational purposes only. This article represents the current market views of the author, and AlphaCore Capital in general, and there is no guarantee that any forecasts made will come to pass. Due to various risks and uncertainties, actual events, results or performance may differ materially from those reflected or contemplated in any forward-looking statements. The opinions are based on market conditions as of the date of publication and are subject to change. No obligation is undertaken to update any information, data or material contained herein.

Neither the information nor the opinions expressed herein constitutes an offer or solicitation to buy or sell any specific security, or to make any investment decisions. AlphaCore provides investment advice only within the context of our written advisory agreement with each AlphaCore client. Past performance is not indicative of future results. The value of an investment may be affected by a variety of factors, including eco- nomic and political developments, interest rates and foreign exchange rates, as well as issuer-specific events.

Any specific security or strategy is subject to a unique due diligence process, and not all diligence is executed in the same manner. All investments are subject to a degree of risk, and alternative investments and strategies are subject to a set of unique risks. No level of due diligence mitigates all risk, and does not eliminate market risk, failure, default, or fraud.

Sources

- https://www.mckinsey.com/industries/financial-services/our-insights/women-as-the-next-wave-of-growth-in-us-wealth-management

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3028071

- https://money.com/stock-market-volatility-women-vs-men/

- https://www.cambridgeassociates.com/insight/gender-lens-investing-impact-opportunities-through-gender-equity/

- https://institute.bankofamerica.com/content/dam/transformation/rising-wealth-of-women.pdf

- https://www.morningstar.com/sustainable-investing/women-account-smaller-percentage-managers-today-compared-with-2002

- https://www.mckinsey.com/industries/financial-services/our-insights/women-as-the-next-wave-of-growth-in-us-wealth-management

- https://www.investmentnews.com/women-advisor-community/women-rely-on-financial-advisers-more-than-men/202962