With the massive shake-up in bond markets this year, we wish to highlight the impact of interest rate moves and share our take on bond opportunities going forward. Both inflationary surprises and resulting aggressive rate hikes by the Fed weighed heavily on the bond market this year, driving yields higher and higher.

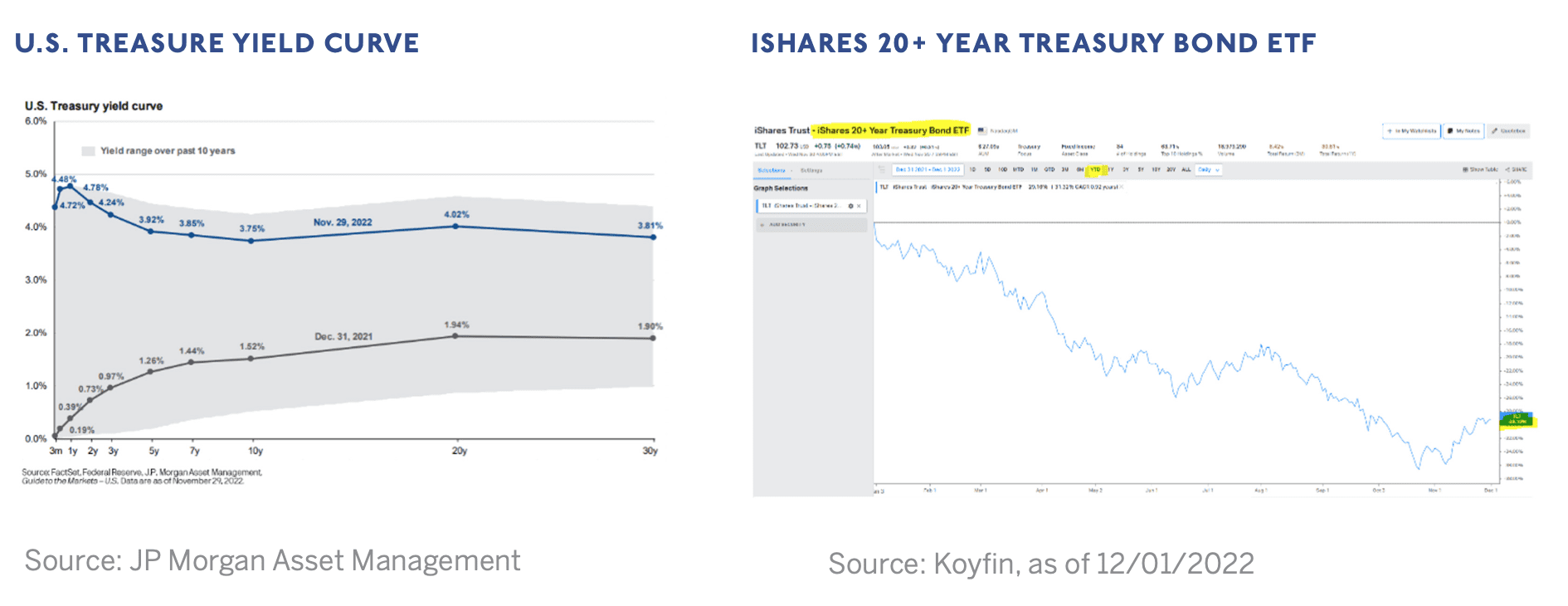

The below chart of the Treasury yield curve at various maturity dates illustrates this dramatic shift. The dark gray line represents the yield curve across various maturities at the end of 2021, while the blue line represents the inverted curve we’ve observed as of November 29, 2022. In response to the Fed’s rapid rate increases, front-end rates jumped from essentially zero to 4.70% over the past year, and yields all along the curve repriced higher. Although this curve can have a broad range of movements (the broad range represented by the shaded gray area), depending on different risk factors, investors generally receive higher compensation for investing in long-dated bonds. The inversion being priced into the yield curve this year (longer-end yields being priced lower than front-end yields) is reflecting the market’s view that inflation will come down quickly in the future likely as a result of a rapidly slowing economy. With that said, investors were punished for owning duration this year given the low starting level for yields back in 2021. The abysmal performance of the iShares 20+ Year Treasury ETF, down nearly 30% this year, underscores this point.

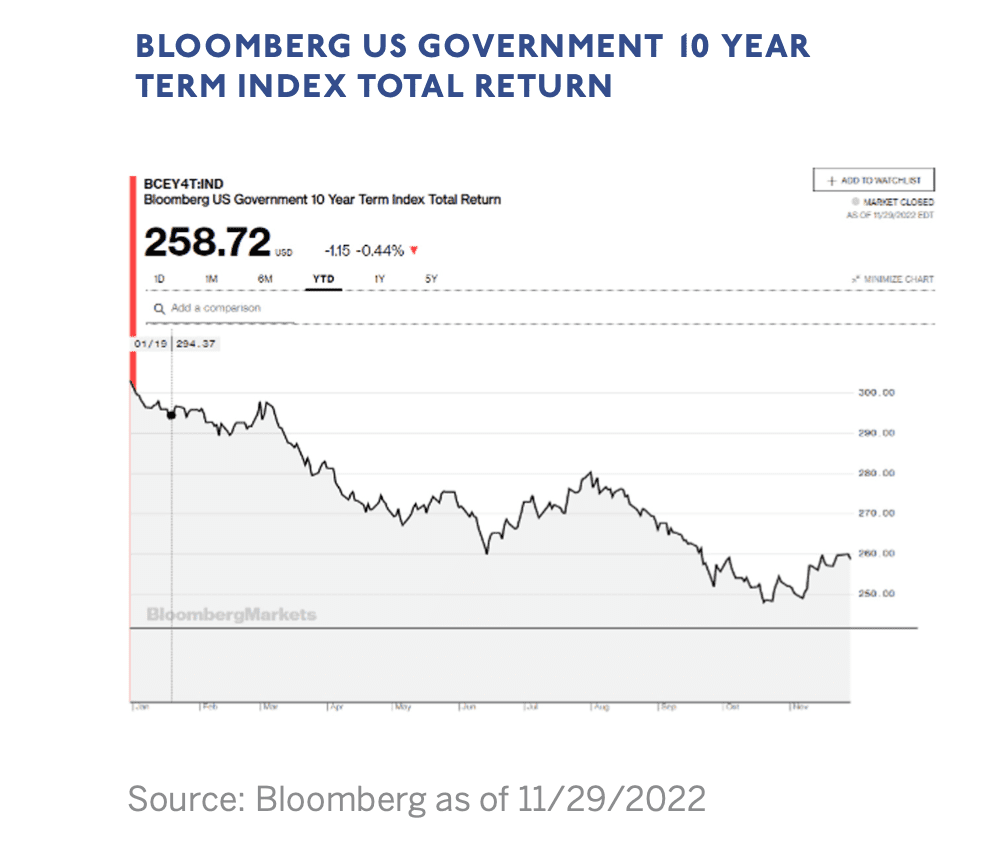

It’s important to acknowledge the pain endured by bondholders over this period. For example, an investor purchases a 10-year bond at the end of 2021, with a yield to maturity of 1.52%. Assuming he or she held this bond to its maturity date, the investor would be paid 1.52% in coupons over 10 years and would also recoup the principal (price paid for the bond) at maturity. However, the market value of the bond will fluctuate over the span of the 10 years with changes in interest rates. During 2022, its value would have taken a big hit since its yield at the time of purchase was merely 1.52%. Inflation has soared above expectations, crippling the purchasing power of fixed income instruments, and the Fed has raised rates. With new bonds issued at much higher yields, the investor’s bond is now worth significantly less. Even with the coupon collected year to date, this bondholder has lost 14.58% on their investment. The path to breakeven remains uncertain as rates could still move higher.

Why the poor performance? The 10-year bond purchased at a 1.52% yield back in 2021 must be repriced to reflect current rates. Its market price has fell to a point where its coupon payment must match that of a comparable 10-year Treasury bond offering a 3.75% yield today. In other words, it was overvalued. Investors often try to rationalize, “Well, as long as I hold to maturity, I will not lose money on my bond position even if rates go up.” This is sadly false – the investor will still suffer opportunity costs.

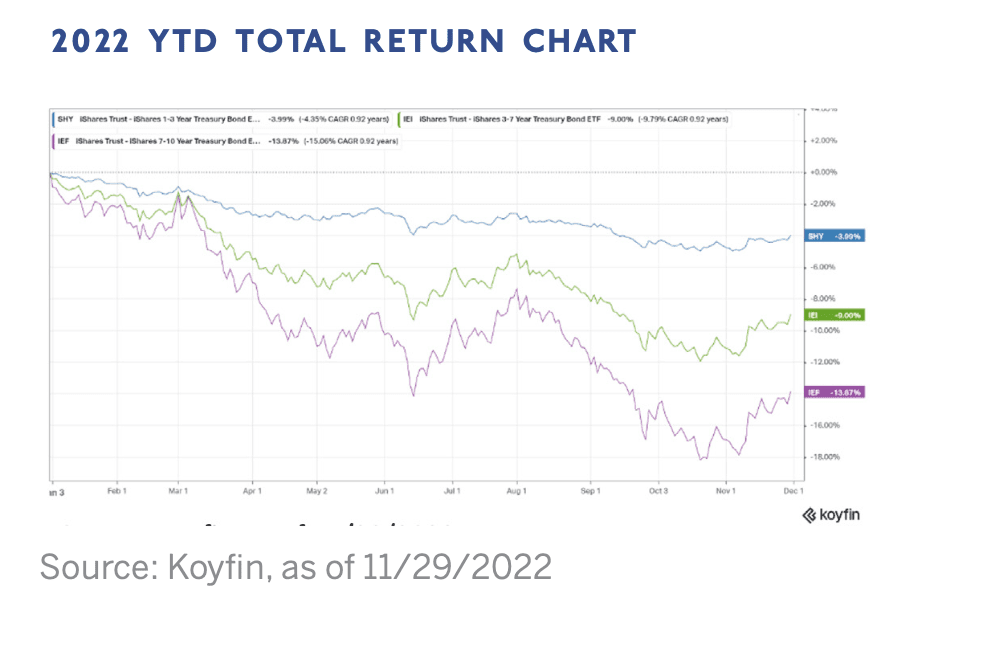

The 2022 YTD total return chart below (as of 11/29/2022) shows several bond-focused ETFs, broken out by maturity of 1-3 years, 3-7 years and 7-10 years. Again, these declines further illustrate the negative dynamic playing out across a vast portion of the bond market.

AlphaCore’s cautious stance on the richly valued bond market coming into 2022 resulted in portfolios being significantly underweight bonds. Our view was that yields would eventually re-price in a higher inflationary regime, and thus we would be able to purchase bonds for our clients at much more attractive prices. This is what has indeed played out.

AlphaCore’s cautious stance on the richly valued bond market coming into 2022 resulted in portfolios being significantly underweight bonds. Our view was that yields would eventually re-price in a higher inflationary regime, and thus we would be able to purchase bonds for our clients at much more attractive prices. This is what has indeed played out.

In conclusion, with the yield curve shifting rapidly and recessionary conditions likely on the horizon, we believe pockets of opportunity will open up in the near future. Similarly, we foresee credit becoming cheaper, presenting opportunities to buy into segments of the bond market with higher yields at lower prices than usual. As the economy slows, we will prioritize liquidity and high-grade municipal or Treasury bonds, and our view on duration is much more favorable. Finally, we believe investment-grade corporates will also cheapen and could potentially offer clients up to 6-8% in yield. Broadly speaking, fixed income yields are at levels we have not seen in over a decade. With that said, we strongly advocate active security selection to take advantage of these types of yield opportunities- higher yield environments may likely coincide with an elevated period of default risk- and thus credit underwriting and active duration positioning will be key in achieving strong risk-adjusted returns. Our dedicated advisory and investment team remain vigilant in monitoring opportunities in the bond market and will continue to guide clients in the coming months to best position their portfolios for the road ahead.

Click here to download the PDF.

Important Information:

This commentary represents the current market views of the author, and AlphaCore Capital in general, and there is no guarantee that any forecasts made will come to pass. Due to various risks and uncertainties, actual events, results or performance may differ materially from those reflected or contemplated in any forward-looking statements. Neither the information nor the opinions expressed herein constitutes an offer or solicitation to buy or sell any specific security, or to make any investment decisions. The opinions are based on market conditions as of the date of publication, and are subject to change. No obligation is undertaken to update any information, data or material contained herein. Past performance is not indicative of future results.

Any specific security or strategy is subject to a unique due diligence process, and not all diligence is executed in the same manner. All investments are subject to a degree of risk, and alternative investments and strategies are subject to a set of unique risks. No level of due diligence mitigates all risk, and does not eliminate market risk, failure, default, or fraud. It should not be assumed that any of the securities transactions or holdings discussed were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable, or will equal the investment performance of the securities discussed herein.