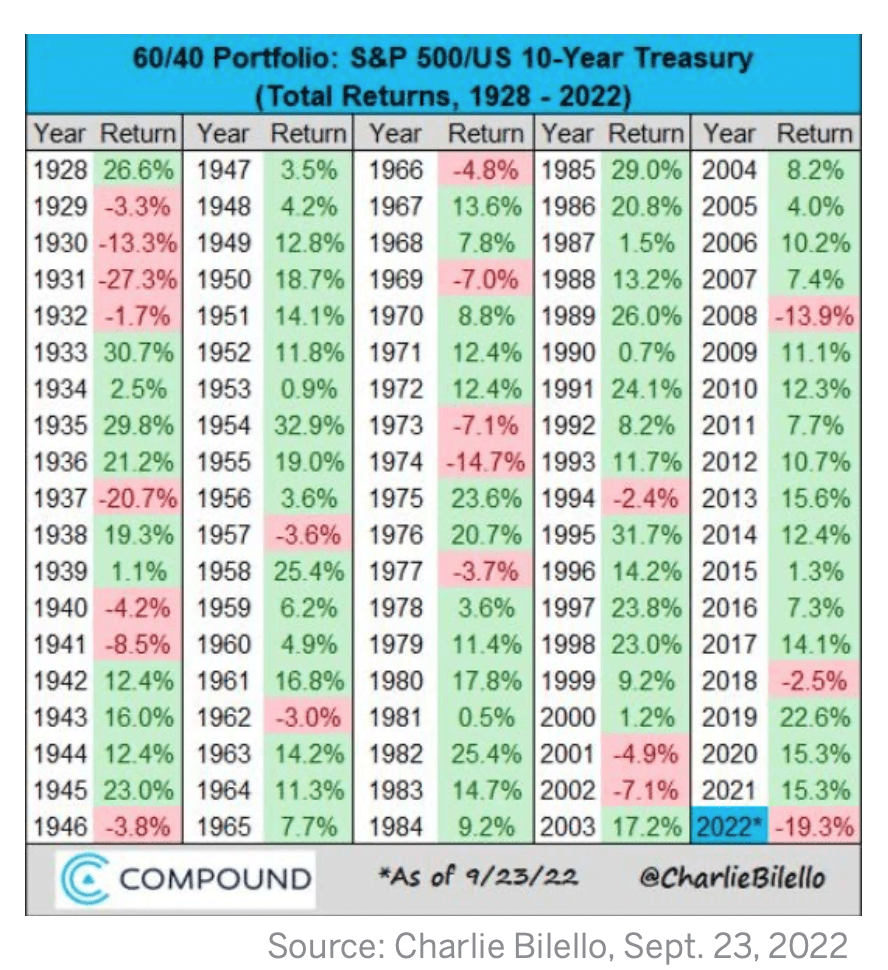

The summer’s market rally may have briefly buoyed investor confidence, but hopes of a full recovery were quickly dashed by August and September’s higher-than-expected inflation prints. Both the headline consumer price index (CPI), as well as core CPI, which excludes food and energy, continue to tick up. These numbers have triggered heightened market volatility over the past couple of months – on the day of August’s print, the Dow Jones Industrial Average plunged 1200 points, and the stock market endured its worst day since 2020. Yield curves inverted once again, with the 2-year treasury now hovering above 4%. For those invested in a traditional “60/40” portfolio, it is trending towards its worst year since 1931! (See chart below.)

As expected, following its September meeting, the Fed announced another 0.75 percentage point increase– the third this year–and indicated that more could still be to come. It is becoming more and more difficult to ignore the reality of an impending recession, and the persistently high inflation in the global economy points to a much-maligned “stagflationary” scenario. Although higher interest rates should help bring inflation under control, economic growth will more than likely take an inevitable hit – historically, 10 of the Fed’s 13 rate hikes since World War II have resulted in a downturn.

Unfortunately, it is likely that we will be sitting with these conditions for some time, given that inflation is much higher and unemployment is much lower than in previous cycles. Moreover, because monetary policy tends to lag, the full impact of these rate hikes will not likely be felt until 2023. Rising costs of capital may feel foreign to corporations and investors accustomed to the past 15 years of low rates and practically “free money.”

Importantly, individual financial planning assumptions need to take into account this new reality of a rising rate environment. Looking ahead, crafting a well-diversified, resilient portfolio is paramount. Incorporating alternative strategies can help investors preserve their wealth and stay on track with their planning objectives in down times.

APPROACHING WEALTH PLANNING AMIDST UNCERTAINTY

These past few months have been a veritable roller coaster for investors. It is easy to feel defeated by this market when its wild swings seem to derail even the most cautious investor’s planning goals. Today’s precarious economic landscape calls for a more flexible, creative approach to wealth planning. Financial planning software, such as eMoney, has been an indisputable boon to investors and financial planners, allowing them to visualize their current and future financial position to help guide investment decisions. eMoney, for example, enables advisors to generate clients’ personal financial statements and run simulations to determine the required return on investments depending on future needs.

While these platforms are great for generating a basic roadmap, it is important to acknowledge their limitations, especially in a more uncertain environment. Typically, these tools run on backward-looking data and base assumptions primarily on equity and fixed-income indices, reflecting the traditional “60/40” approach to asset allocation. But as we observe greater and more persistent volatility, this standard portfolio is starting to show its weakness.

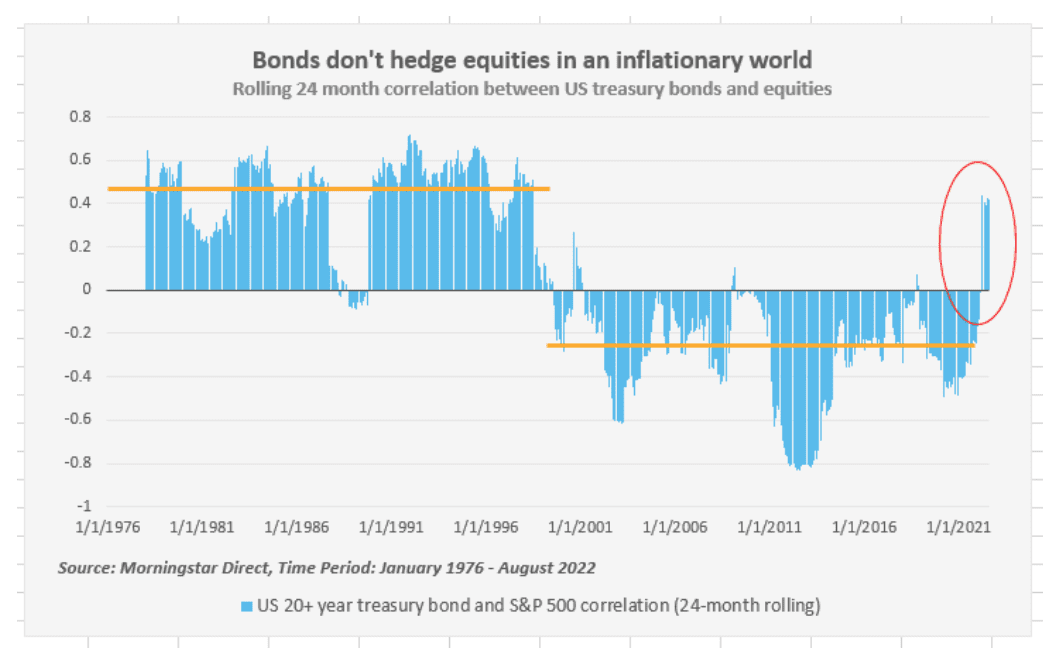

The 60/40 portfolio is often considered the gold standard for investors looking to earn attractive risk-adjusted returns. The logic behind this allocation strategy is simple – stocks offer long-term growth potential while bonds provide income and help mitigate some of the volatility in the equities market. Typically, these exhibit relatively low correlation to each other and have differentiated risk profiles. “Risk” is measured by the standard deviation or volatility of the

returns of a particular strategy. Because returns on fixed-income securities are historically less variable, bonds are considered a “safer” investment. The downside of using standard deviation to measure risk is that it only considers past performance, ignoring broader economic factors that may influence an asset’s future performance.1 Relying on this myopic data point can result in a misguided response to what is currently happening in the market.

Normally, bonds provide a decent hedge for equities during a recession. Bond prices increase as interest rates are lowered to stimulate the economy. However, when inflation is thrown into the mix, rates are adjusted higher to compensate investors adequately, and instead, bond prices tend to fall thus, the playbook has to change. Stocks and bonds are declining simultaneously, and it is safe to say that we haven’t seen anything that resembles our current situation since the early 70s. The majority of financial planning software only tracks index returns for the past 15-30 years, so today’s analogue is firmly out of their purview.

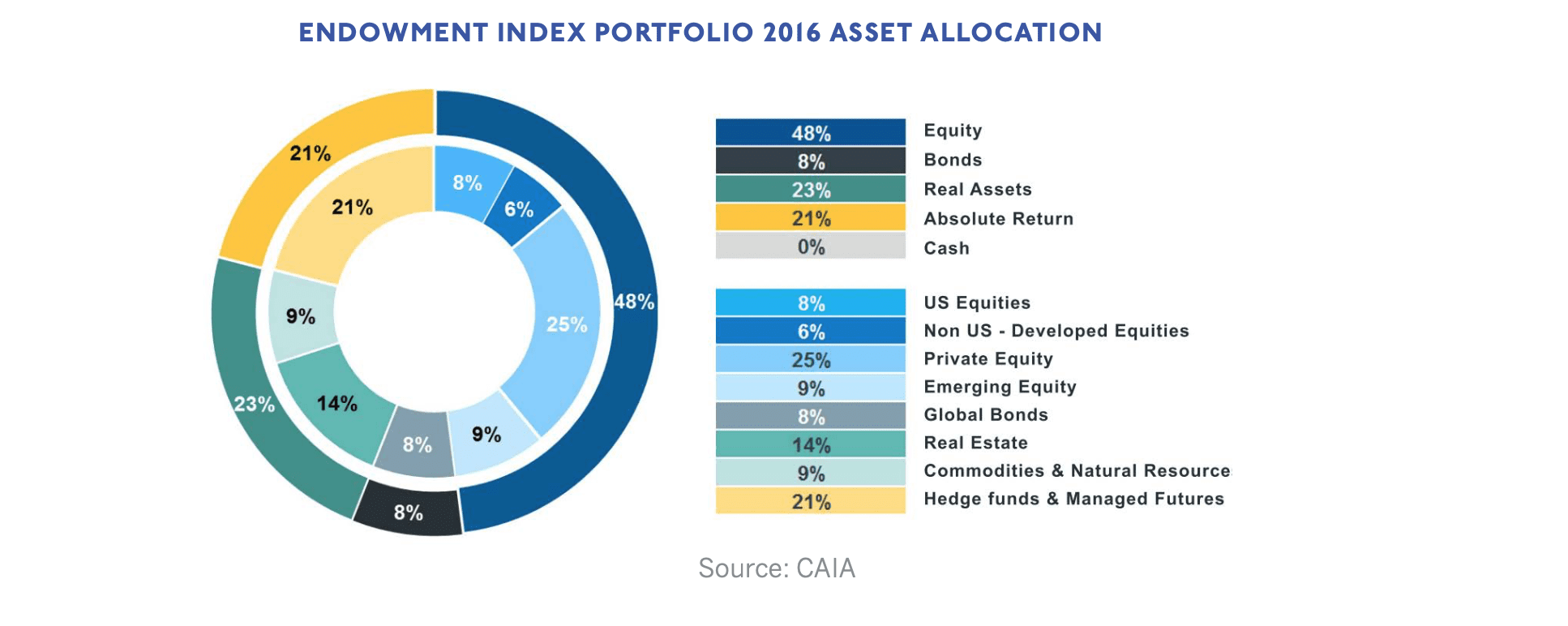

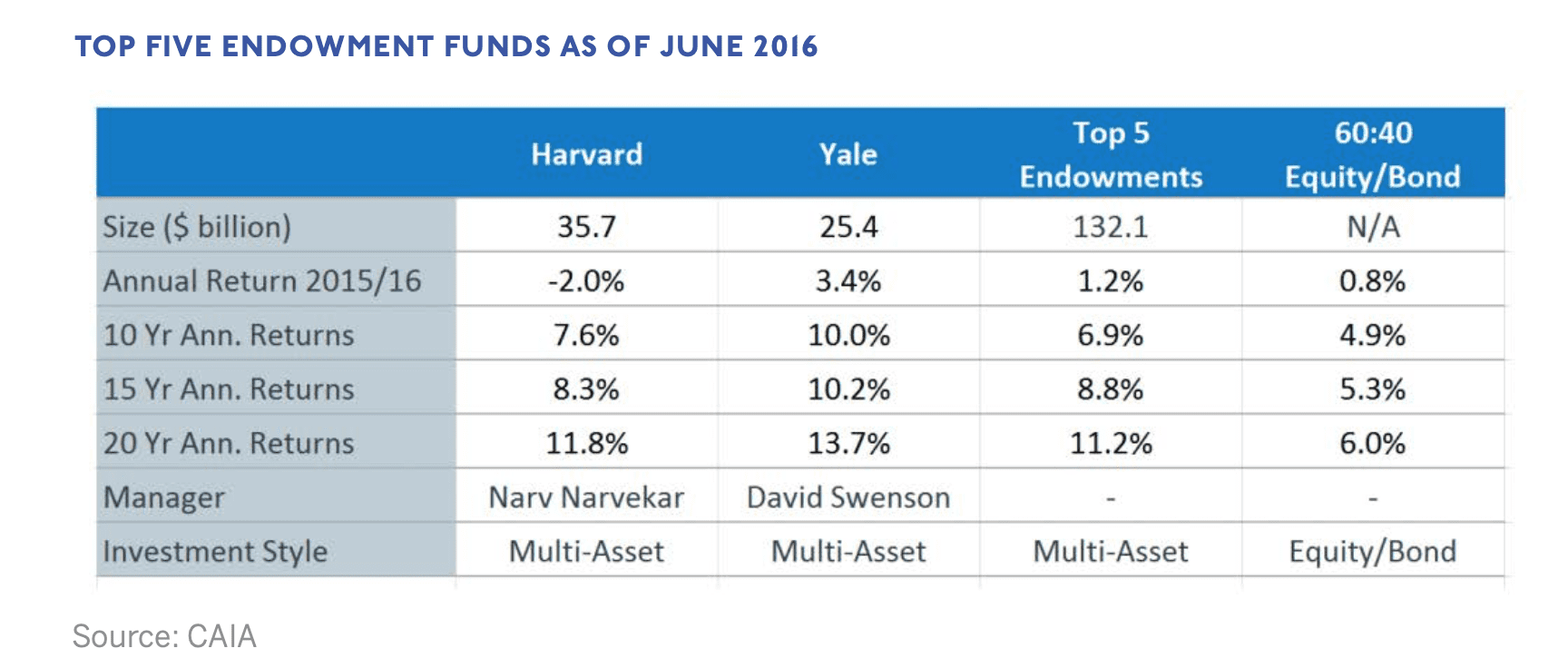

We are living in a new reality for anyone who has built up their net worth post-1980. Investors and savers will need to add a new component to their portfolios. There is another approach that pensions and endowments have been using for decades. Pioneered by David Swenson at Yale and implemented widely throughout higher education institutions, the endowment model allocates across a diversified mix of exposures. In fact, some investment programs allocate up to 21% of the portfolio to alternative strategies (hedge funds and managed futures).2 This approach can be and should be considered for adoption for individuals.

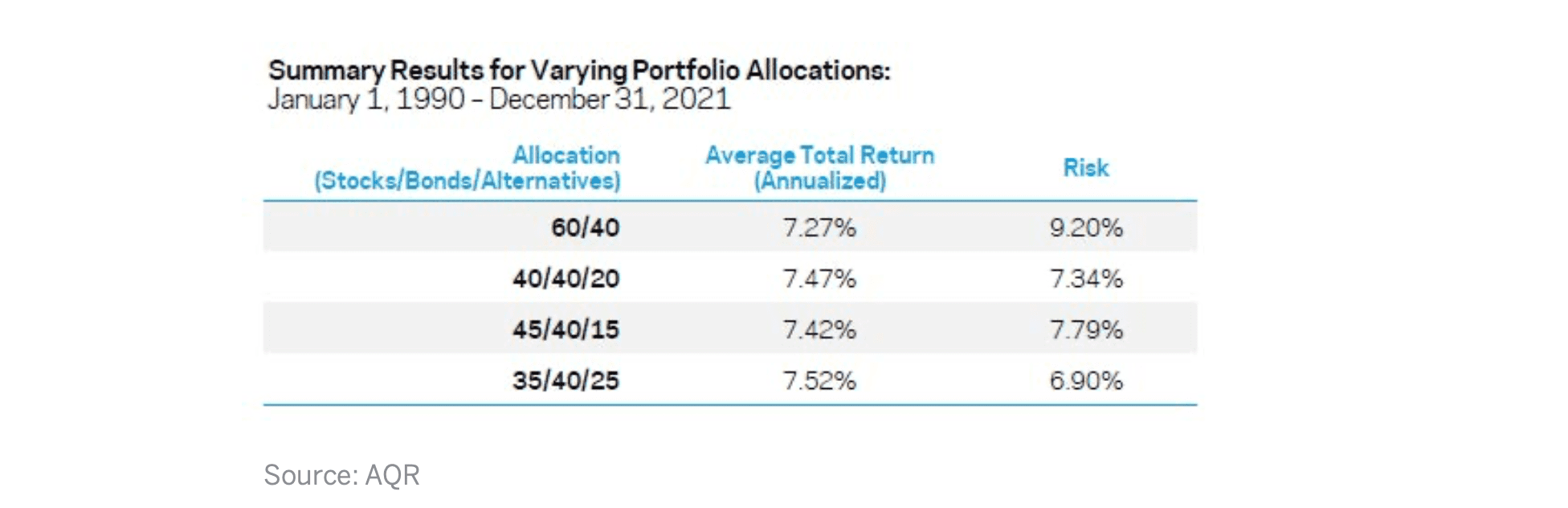

Allocating a percentage of the portfolio to alternatives with low correlation to the bond and equity markets can enhance diversification to help mitigate losses. Alternative assets include commodities, private equity, venture capital and hedge funds, while alternative strategies encompass trading strategies besides long- only. The reason why they can be beneficial is because they introduce unique sources of risk and return compared to traditional holdings. They aren’t just a good hedge in a down market – they have proven track records over multiple market cycles. In fact, the data suggests that portfolios with alternative exposures achieve stronger risk-adjusted returns over time than portfolios with stocks and bonds alone. However, due to the sophistication of these assets, it is crucial to find an advisor with both alternatives and financial planning expertise.

ALTERNATIVE STRATEGY HIGHLIGHT: GLOBAL MACRO AND MANAGED FUTURES

Managed futures and global macro are two alternative strategies that have performed exceptionally well in rising rate and volatile environments. A key component of these strategies is their ability to go both long and short, which is essential during periods of high dispersion like we are currently experiencing. In addition, these two strategies can give an investor exposure to four of the largest asset classes including currencies, commodities, fixed income and equities.

A managed futures strategy seeks to deliver absolute returns through implementing a variety of systematic, trend-following models. Managers first determine the directional position of an asset in a portfolio, then assign positively-trending assets a long position and negatively-trending assets a short position, with the goal of generating returns in both rising and falling markets. Because this strategy takes a comprehensive approach to trend-following, across multiple assets, models and time frames, it provides uniquely robust diversification. While funds that utilize managed futures have tended to track or outperform both US and world stocks over the past 25 years, it is during “bad” times when this strategy really shines and protects portfolios against crippling losses.

The global macro strategy approach is informed by broader economic and political factors. This type of fund has a vast amount of flexibility enabling managers to take long and short positions in various asset classes including stocks, bonds, commodities, currencies and futures markets. Similar to managed futures, this flexibility also provides excellent diversification.

IN CONCLUSION

When constructing financial plans, it is imperative that advisors and clients utilize strategies that can proactively manage overall portfolio risk by introducing various sources of risk. In today’s market environment, we utilize alternative strategies including managed futures and global macro because they offer differentiated returns that may help insulate portfolios from losses during market drawdowns. These strategies can be especially useful during inflationary periods like the one we are experiencing today. By incorporating these diversifying strategies, an investor can feel more confident that their plan’s assumptions will have a much higher probability of becoming realized.

Click here to download the PDF.

The MSCI World Index is a free float-adjusted market capitalization index that is designed to measure the large and mid-cap equity market performance of 23 developed countries.

The Bloomberg Barclays U.S. Aggregate Bond Index, which until August 24, 2016 was called the Barclays Capital Aggregate Bond Index, and which until November 3, 2008 was called the “Lehman Aggregate Bond Index,” is a broad base index, maintained by Bloomberg L.P. since August 24, 2016, and prior to then by Barclays which took over the index business of the now defunct Lehman Brothers, and is often used to represent investment grade bonds being traded in United States. Index funds and exchange-traded funds are available that track this bond index.

The HFRI Fund Weighted Composite Index is a global, equal-weighted index of over 1,500 single-manager funds that report to HFR Database. Constituent funds report monthly net of all fees performance in US Dollar and have a minimum of $50 Million under management or a twelve (12) month track record of active performance. The HFRI Fund Weighted Composite Index does not include Funds of Hedge Funds.

This commentary represents the current market views of the author, and AlphaCore Capital in general and there is no guarantee that any forecasts made will come to pass. Due to various risks and uncertainties, actual events, results or performance may differ materially from those reflected or contemplated in any forward-looking statements. The opinions are based on market conditions as of the date of publication and are subject to change. No obligation is undertaken to update any information, data or material contained herein.

AlphaCore provides investment advice only within the context of our written advisory agreement with each AlphaCore client. Any strategy referenced may not represent investment management, securities purchased, sold, or recommended for all client accounts. It should not be assumed that any strategy or investment recommendations or decisions we make in the future will be profitable. Past performance is not indicative of future results.

The commentary may utilize index returns, and you cannot invest directly into an index without incurring fees and expenses of investment in a security or other instrument. In addition, performance does not account other factors that would impact actual trading, including but not limited to account fees, custody, and advisory or management fees, as applicable. All of these fees and expenses would reduce the rate of return on investment.