Get ready for the

2024 AlphaCore Wealth Summit

Sept. 19, 2024 | La jolla, CA

Let’s Come Together for AlphaCore’s Biggest Event of the Year

We Can Work It Out at AlphaCore’s flagship educational event where attendees will hear from who we believe are the foremost thought leaders in the wealth management industry. Our roster of renowned experts will Help! navigate a variety of valuable financial topics with engaging discussions on innovative investment strategies and planning tactics to potentially strengthen portfolios and protect wealth over time.

Don’t miss an unforgettable event experience with a surprise entertainment factor that we promise will be Something inspiring!

1

Day

Event

20

Manager

Panelists

3

Keynote

Speakers

6

Expert

Panels

Adam Butterfield

Regional Consultant

Adam is responsible for business development, client service and outside marketing efforts at SpiderRock Advisors. In addition to his business development & client service responsibilities, Adam co-manages the internal analyst desk for the firm. Prior to joining SpiderRock, Adam began his career at Stout Risius Ross, Inc. providing financial valuations on fairness and solvency opinions for both corporate acquisitions and divestitures including mergers and acquisitions, equity offerings, and leveraged buy-outs in regard to privately-held ESOP companies. Adam earned his undergraduate degree in Public Policy specializing in Economics from the University of Chicago and is a Chartered Alternative Investment Analyst (CAIA) Charterholder.

Anastasia Amoroso

Managing Director, Chief Investment Strategist

Anastasia Amoroso is a Managing Director and the Chief Investment Strategist at iCapital. In this role, she is responsible for providing insight on private and public market investing opportunities for advisors and their high-net-worth clients. Previously, Anastasia was an Executive Director and the Head of Cross-Asset Thematic Strategy for J.P. Morgan Private Bank, where she identified and invested in emerging technologies and disruptive trends such as artificial intelligence, decarbonization, and gene therapy. She also developed global tactical ideas and implemented institutional-level implementation across asset classes for clients. Anastasia regularly appears on CNBC and Bloomberg TV and is often quoted in the financial press. Prior to this, Anastasia served as a Global Market Strategist on the J.P. Morgan Funds Global Market Insights Strategy team. She also managed global tactical multi-asset portfolios and performed investment due diligence at Merrill Lynch, as well as provided consultative financial advisory services to high-net-worth families and businesses. Earlier in her career, Anastasia held several financial analysis, research, and strategic business planning positions with both private and public sector organizations. She graduated summa cum laude from the University of New Mexico and is a CFA charterholder.

Frances Beyers

Portfolio Manager

Fran is a portfolio manager for the Cliffwater Corporate Lending Fund and the head of Cliffwater’s capital markets group. In this role, Fran is responsible for sourcing middle market lending opportunities and maintaining manager relationships to support Cliffwater’s rapidly growing multi-manager private debt asset management business. Prior to joining Cliffwater in 2020, Fran was Head of Middle Market Loan Analysis for Refinitiv. Previous roles include underwriting and portfolio management at Churchill Asset Management, and she began her career in Corporate Finance Advisory at JPMorgan. She earned a BS in Business Administration from Washington University in St. Louis.

Michael Smith

Partner, Co-Head of Ares Credit Group

Mr. Smith is a Partner and Co-Head of the Ares Global Credit Group. Additionally, Mr. Smith serves as Portfolio Manager of CION Ares Diversified Credit Fund (“CADEX”). He serves on the Ares Executive Management Committee. Additionally, he serves as a Director of Ares Capital Corporation (“ARCC”) and previously served as Co-President of Ares Capital Corporation from July 2014 to October 2022 and Executive Vice President from May 2013 to July 2014. He is a member of the Ares Credit Group’s U.S. Direct Lending, Opportunistic Credit and Commercial Finance Investment Committees, the Ivy Hill Asset Management Investment Committee, the Ares Secondaries Group’s Private Equity Investment Committee, and the Ares Infrastructure Group’s Infrastructure Opportunities, Climate Infrastructure Partners and Infrastructure Debt Investment Committees. Prior to joining Ares in 2004, Mr. Smith was a Partner at RBC Capital Partners, a division of Royal Bank of Canada, which led the firm’s middle market financing and principal investment business. Previously, Mr. Smith worked at Indosuez Capital in their Merchant Banking Group, Kenter, Glastris & Company, and at Salomon Brothers Inc, in their Debt Capital Markets Group and Financial Institutions Group. Mr. Smith serves on the Board of Directors of the University of Notre Dame’s Wilson Sheehan Lab for Economic Opportunity (LEO), which helps service providers apply scientific evaluation methods to better understand and share effective poverty interventions. Mr. Smith received a B.S. in Business Administration from the University of Notre Dame and a Masters in Management from Northwestern University’s Kellogg Graduate School of Management.

David Stubbs

Blackstone

David Stubbs is a Managing Director and the Senior Investment Strategist for the Americas in the Private Wealth Solutions group. Dr. Stubbs previously spent 8 years at J.P. Morgan, where he was most recently the Global Head of Thematic Investing for their Wealth Management business. Prior to that role he was the Head of Investment Strategy for their International Private Bank and a Global Macro Strategist in their Asset Management business. Previously, Dr. Stubbs has worked at the United Nations Department for Economics and Social Affairs and the International Development arm of the U.K. government. Dr. Stubbs received a Ph.D. in Economics from the New School for Social Research, an M.Sc. in International Political Economy from the London School of Economics and Political Science, and a B.Sc. in Economics and Politics from the University of Birmingham. He is on the board of the Children’s Environmental Literacy Foundation and is a CMT and FRM holder.

Jeffrey Rosenberg

Managing Director

Jeffrey Rosenberg, CFA, Managing Director, leads active and factor investments for mutual funds, institutional portfolios and ETFs within BlackRock’s Systematic Fixed Income (“SFI”) portfolio management team. In this role he serves as a member of the SFI Investment and Executive Committees and as a senior portfolio manager for a number of our investment products including the Systematic Multi-Strategy fund.

Mr. Rosenberg’s service with the firm dates back to 2011, when he joined the Fundamental fixed income group as Chief Investment Strategist for fixed income. In 2016, this role transitioned into the BlackRock Investment Institute. His responsibilities included helping to develop BlackRock’s strategic and tactical views on sector allocation within fixed income, currencies and commodities.

Prior to joining BlackRock, Mr. Rosenberg spent nearly 10 years at Bank of America Merrill Lynch as the Chief Credit Strategist coordinating strategy across all fixed income, securitized assets, credit, FX and commodities. In addition, Mr. Rosenberg specialized in quantitative credit modeling and developed the first commercialized credit portfolio analytics system from a dealer firm.

Mr. Rosenberg earned a Master of Science degree in Computational Finance from Carnegie Mellon, a BA in Mathematics from the Univ. of Minnesota, and a BA in Finance from the Univ. of Wisconsin.

Gary Rozier

Managing Director

Gary Rozier serves as Managing Director for the Oak Street division of Blue Owl Capital in its Chicago Illinois office. Gary leads the Investor Relations and Institutional Marketing team for Oak Street, which is responsible for investor communications, capital raising and client servicing. He also serves on the investment committee for the Net Lease strategies. Gary served as Senior Vice President at Ariel Investments for 14 years where he was responsible for institutional business development and client services. Prior to joining Ariel, Gary spent five years with Rydex Investments, holding multiple positions in shareholder services and financial advisor sales before being promoted to regional vice president where he oversaw product development and distribution across nine states in the Midwest. Gary serves on the board of directors for City Colleges of Chicago Foundation, National Equity Fund and the advisory committee for Clifford Capital Partners. Additionally, Gary is a trustee for Frances Xavier Warde School and a 2011 Leadership Greater Chicago fellow. Gary earned a Bachelor of Arts degree in economics from the University of Maryland, where he serves on its Board of Visitors, Economics Leadership Council and was a captain of the rugby team.

Michael Liang

Managing General Partner

Michael Liang, Ph.D. is a Managing General Partner with InVivium Capital. Previously, Mike spent 16 years as a Partner with Baird Capital, overseeing healthcare investments. Prior to joining Baird Capital, Mike was a healthcare investor with Advent Venture Partners (London, U.K.) and before that served in an operating role as a Director of R&D at Cortek, a spinal orthopedics company. Mike serves on the Board of Directors of Jumpcode Genomics, and recently served on the Board of Directors of AiCure, NeoChord and Zurex Pharma, and was a Board Observer for Saranas and Virtual Incision. Mike was also previously a Board Member of GreenLight Biosciences (NASDAQ: GRNA) Interlace Medical (sold to Hologic), OncoHealth (sold to Arsenal Capital Partners), Veniti (sold to Boston Scientific), and a board observer of TomoTherapy (NASDAQ: TOMO, sold to Accuray). Mike received a B.S. in bioorganic chemistry from the University of California, Berkeley, completed a Ph.D. in biophysical chemistry from Stanford University, and conducted a postdoctoral fellowship at Harvard University.

Jeremy Caldwell

Partner

Dr. Caldwell is a partner at Red Tree Venture Capital. A widely respected executive and scientist with deep industry expertise built through a decorated career of industry and venture activities, Dr. Caldwell’s accomplishments span from creating innovative drug development companies to driving discovery, development and translation of novel therapies. He has forged deep ties to the San Diego and San Francisco Bay Area biotechnology communities, as well as far-reaching relationships within the global pharmaceutical space. Most recently Dr. Caldwell was CEO of Inception Therapeutics, Versant Ventures’ San Diego-based discovery engine for new company formation, a venture partner with Versant Ventures and a member of the firm’s investment team. In these roles, he co-led in the formation of Chinook Therapeutics (acquired by Novartis for $3.5B), and co-led the investment and formation of Lycia Therapeutics, Belharra Therapeutics, Light Horse Therapeutics, among others, acting as founding CEO and board director of each. Prior to Inception/Versant, Dr. Caldwell was an entrepreneur-in-residence at Third Rock Ventures, where he participated in the genesis and formation of Revolution Medicines (RVMD), Pliant Therapeutics (PLRX), Decibel Therapeutics (DBTX), Relay Therapeutics (RLAY) and Nurix Therapeutics (NRIX). He also played key roles in the foundational science on which Rigel, Inc. (RIGL), and Kalypsys, Inc., were formed, as well as advising in the evolution of Syrrx, Inc. (acquired by Takeda for $270M). With drug discovery and development expertise primarily focused on oncology, immunology, neurology and cardiometabolic disease, Dr. Caldwell is credited with significant contributions to research leading to four commercial drugs. He previously served as executive vice president and chief scientific officer at Ardelyx, Inc., where he advanced a portfolio of novel anti-fibrotic and cardiorenal therapeutics to the clinic. His career has also included key leadership roles with Sirna, Merck Research Laboratories, and the Genomics Institute of the Novartis Research Foundation (GNF). Dr. Caldwell is a member of the board of Sardona Therapeutics and Biograph 55. He received a B.A. in molecular and cellular biology with an emphasis in neuroscience from the University of California at Berkeley and a Ph.D. in molecular pharmacology from Stanford University.

Ari Rosenbaum

Principal, Director of Private Wealth Solutions

Ari Rosenbaum serves as the Director of Private Wealth Solutions at O’Shaughnessy Asset Management (OSAM). He began working with Jim O’Shaughnessy in 1997, and leads the team that delivers OSAM strategies to advisors, consultants, wealth management firms, multi-family offices and private banks. Over his career, he has worked with hundreds of wealth advisory firms coast to coast. Ari is a member of the firm’s Executive Committee. Prior to joining OSAM, Ari was in charge of national sales for financial advisors at Bear Stearns Asset Management. Ari graduated from Penn State University in 1991 with a B.A. in English. He lives in Ridgefield, Connecticut with his wife and two children.

Nick Veronis

Co-Founder & Managing Partner, Head of Portfolio Management

Nick is Co-Founder and one of the Managing Partners of iCapital, where he is Head of Portfolio Management. He is also a member of the company’s Operating Committee. Nick spent 11 years at Veronis Suhler Stevenson (VSS), a middle market private equity firm where he was a Managing Director responsible for originating and structuring investment opportunities. At VSS, he specialized in the business information services sector and helped spearhead the firm’s investment strategy in the financial software and data sector, including its investment in Ipreo. Nick was previously an operating advisor to Atlas Advisors, an independent investment bank based in New York. He began his career as a financial journalist for The Boston Business Journal, was a reporter for The Star-Ledger, and a Senior Associate in the New Media Division of Newhouse Newspapers. He holds a BA in economics from Trinity College and FINRA Series 7, 79, and 63 licenses.

Sean O’Hara

Director

Sean began his career at PLANCO/Hartford in 1985, where he spent 22 years as wholesaler, divisional manager, and managing director of the national wholesaler team. In 2007, Sean joined Joe Thomson again, co-founder of PLANCO, at Pacer Financial to serve as a national wholesaling company for various products including exchange traded funds, exchange traded notes, Annuities, and SMAs. In 2015, Pacer ETFs was launched. With Sean’s leadership, the company has become one of the fastest growing ETF companies. Sean often appears on Fox Business Network, CNBC, and various other news outlets to give insight into the market.

Jessica Munoz

President and CEO

Jessica Muñoz is the President and CEO of Voices for Children. Voices for Children is the Court Appointed Special Advocate (CASA) program serving San Diego and Riverside Counties and the Pechanga Tribe. Before becoming VFC’s CEO in 2023, Jessica led Voices for Children’s Riverside County program. Jessica is an attorney and has practiced for more than seven years, including as a trial attorney in juvenile dependency courts. Prior to joining Voices for Children in 2016, she developed and coordinated a program at UC San Diego to provide support services to students who are undocumented. In addition to her law degree, she holds a Master of Forensic Science degree and a professional certificate in nonprofit management. Jessica is a past chair of the County of San Diego – Juvenile Justice Commission and served on the board of the San Diego Civic Youth Ballet. Her professional affiliations include the State Bar of California, Leadership Riverside, and The Fieldstone Leadership Network-San Diego. Jessica was also named the 2022 Juvenile Law Attorney of the Year by the Riverside County Bar Association.

Julie Bartlett

Director

Juli is Director of Charitable Consulting at Schwab Charitable. Juli provides independent investment advisors, family offices, and donor communities innovative solutions to incorporate charitable planning into wealth management strategies and helps clients achieve maximum charitable impact. A seasoned relationship management professional with more than 20 years of industry experience, Juli has been with Charles Schwab since 1999, most recently as a Relationship Manager on the Advisor Services team in Southern California. Juli received a Bachelor of Science degree in Science Education with a specialization in Biology from the University of Central Florida and holds the Series 7, 9, 10, and 63 securities licenses. She lives in Los Angeles and directs her charitable efforts towards improving the lives of animals in need and tutoring students in math and reading.

Anne Marbarger

CEO

Anne Marbarger is the CEO of Curebound, a San Diego-based organization committed to accelerating cures for cancer by funding collaborative research among San Diego’s top cancer research centers.Curebound is well on its way to a bold goal of raising and investing $100 million in game-changing research projects that show promise of translating basic discoveries to clinical and commercial stages.

Anne steps into the Curebound CEO position after having led Curebound’s predecessor organization, Padres Pedal the Cause for six years during which time the organization raised $10 million for cancer research. Under Anne’s leadership, Curebound expands beneficiary research partnerships with Moores Cancer Center at UC San Diego Health, the Salk Institute, Sanford Burnham Prebys, and Rady Children’s Hospital to now include two new powerhouses: Scripps Research and La Jolla Institute for Immunology.

A natural consensus-builder and community collaborator, Anne leads the transformation from Padres Pedal the Cause to Curebound including the creation of a new Scientific Advisory Board to guide the organization’s investments, an acquisition of partner organization, the Immunotherapy Foundation, and formation and rollout of the Curebound brand. Curebound will build off this collective foundation of $26 million awarded, and 95 innovative research grants and clinical trials funded, and one of the largest cancer fundraising events on the West Coast.

Prior to joining Pedal the Cause in 2015, Anne worked in management consulting in Washington, DC, within Deloitte Consulting’s federal human capital practice. Earlier in her career, she served as an intelligence analyst at the United States Treasury Department with a focus on major Middle East terrorist organization illicit funding sources and use of the US financial system. She holds a Bachelor’s Degree in Government from Dartmouth College and an MBA from George Washington University.

Stacey Havener

Founder & CEO

Stacy Havener has a made a career raising $8B+ for new/undiscovered funds that led to $30B+ in follow-on AUM. Prior to finding her niche in raising capital, she was an award-winning writer who dreamed of becoming a literature professor. Ironically, her love of words is one of the secrets to her success in an industry dominated by numbers. Growing up the only girl on all-boy soccer teams, it’s no surprise she’s now a female entrepreneur in one of the toughest “boys clubs.” At the heart of it all, there is one thing Stacy believes in – underdogs. Stacy is the Founder/CEO at Havener Capital Partners, a sales and marketing agency that helps boutique asset managers build, launch and grow funds. Havener Capital is on a mission to level the playing field in asset management by raising $100B for boutiques over the next decade. Stacy holds her Series 6, 7, 24, 63, 66, and 79 licenses and is a registered representative of Compass Securities Corporation. She received her Bachelor of Arts in English Literature from Western Connecticut State University, graduating summa cum laude in 1998. That same year, Stacy was named to both the NCAA and the GTE/CoSida Academic All-American teams for Division III Women’s Soccer and subsequently nominated for NCAA Woman of the Year. Based in Newport, RI, Stacy often spends her mornings walking the beach, sipping a Dunkin’ coffee, and listening to 90’s hip hop.

Ali Motamed

Founder & Managing Partner

Founder, Managing Partner, and Portfolio Manager. Prior to founding Invenomic, Ali was Co-Portfolio manager of the Boston Partners Long/Short Equity Fund. He was awarded Portfolio Manager of the Year in the Alternatives Category by Morningstar in 2014. Prior to joining Boston Partners, he was a member of the global mergers and acquisitions teams at Deutsche Bank and BT Wolfensohn. Mr. Motamed holds a B.A. degree in economics with a minor in accounting from the University of California, Los Angeles, and a M.B.A. degree from Harvard Business School. He holds the Chartered Financial Analyst designation. He has twenty years’ experience. When he is not working, Ali enjoys spending time with his wife and four kids and participating in outdoor activities. Although he grew up in California, he has converted to a full-fledged Boston sports fan and particularly enjoys cheering for the Celtics and Patriots.

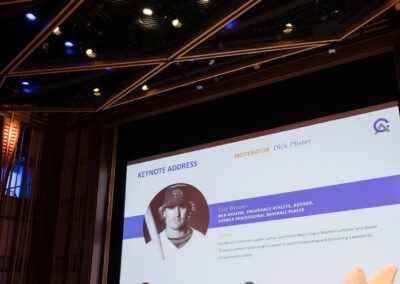

Meet Our Keynote Speakers

Anastasia Amoroso

iCapital

David Stubbs

Blackstone

Jeffrey Rosenberg

BlackRock

Schedule of Events

8:30 AM PT

9:15 AM PT

10:00 AM PT

10:15 AM PT

11:15 AM PT

12:00 PM PT

1:00 PM PT

1:30 PM PT

2:15 PM PT

3:00 PM PT

3:45 PM PT

4:15 PM PT

5:00 PM PT

5:30 PM PT

6:30 PM PT

8:00 PM PT

Doors Open | Coffee & Conversation with the AlphaCore Team | Breakfast Served

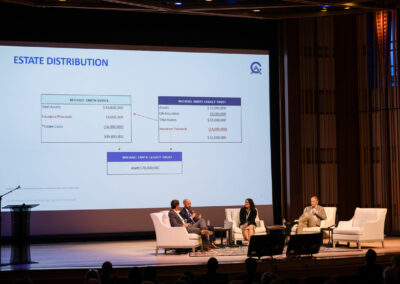

Wealth Planning Demonstration* | Yesterday

AlphaCore Wealth Advisory Welcome | Come Together

Macro Keynote | Now and Then

Income Solutions | Don’t Let Me Down

Lunch

AlphaCore Wealth Advisory Overview | Let It Be

Future Healthcare Solutions | Imagine

Growth Solutions | Here Comes the Sun

Charitable Giving Solutions | With a Little Help From My Friends

Women, Wealth & Leadership | Twist & Shout

Macro Keynote | Across the Universe

Fireside Chat | Help!

Cocktail Reception with Heavy Hors’doeuvres

Evening Entertainment | The Fab Four Beatles Tribute

2nd Annual Summit Concludes

* This session will occur during the breakfast and networking before the official Wealth Summit opening session. Attendees need to register separately for this workshop. Please speak with your advisor if you are interested.

The Venue

The 2024 Summit will take place at The Conrad Prebys Performing Arts Center.

Speaker Spotlight

Adam Butterfield

SpiderRock

Frances Beyers

Cliffwater

Michael Smith

Ares

Gary Rozier

Blue Owl Real Estate

Michael Liang

Invivium Capital

Jeremy Caldwell

Red Tree Venture Capital

Ari Rosenbaum

OSAM

Nick Veronis

iCapital

Sean O’Hara

Pacer

Jessica Munoz

Voices for Children

Julie Bartlett

Schwab Charitable

Anne Marbarger

CureBound

Stacey Havener

Havener Capital Partners

Ali Motamed

Invenomic Capital Management

Our 2024 Sponsors

Diamond Sponsors

Learn More

iCapital is the financial technology company with the mission to power the world’s alternative investment marketplace. Our clients benefit from iCapital as the industry’s trusted technology partner, providing an end-to-end lifecycle operating system that empowers them to explore, invest in and adopt alternative products. With iCapital’s solutions, iCapital strives for customers to gain the confidence to navigate and engage seamlessly in the world of alternative investments, ensuring a reliable and efficient investment experience aligned with their financial goals.

Platinum Sponsors

Learn More

BlackRock is one of the world’s leading providers of investment, advisory and risk management solutions. They are a fiduciary to their clients. They are investing for the future on behalf of their clients, inspiring their employees, and supporting their local communities.

Learn More

Cliffwater LLC is an independent investment adviser and asset manager that provides research, advisory, and investment services. As a leader in alternatives, they work with institutional investors across the alternative investment landscape. Whether as an adviser or a manager, they help clients develop customized, diversified portfolios that balance return, volatility, and liquidity most effectively.

Learn More

1WS Capital Advisors, LLC (the “Adviser” or “1WS”) manages 1WS Credit Income Fund (the “Fund”), a closed-end interval fund. The Adviser is the individual investor focused affiliate of One William Street Capital Management L.P. (“OWS”). OWS is an employee-owned global alternative credit focused asset management platform with more than 85 employees and approximately $5.5 billion of assets under management. OWS’s global investor base is primarily institutional, including pensions and sovereign wealth funds.

Learn More

Ares Management Corporation (NYSE: ARES) is a leading global alternative investment manager offering clients complementary primary and secondary investment solutions across the credit, real estate, private equity and infrastructure asset classes. They seek to provide flexible capital to support businesses and create value for their stakeholders and within their communities. By collaborating across their investment groups, they aim to deliver consistent and attractive investment returns throughout market cycles.

Gold Sponsors

Learn More

Invenomic employs a disciplined, fundamentally-driven research process to build a diversified portfolio of U.S. focused long and short equity investments that they believe will provide competitive performance in most market environments. Invenomic leverages what they believe are the best features of quantitative analysis on the front end of their process to source ideas and then applies traditional fundamental analysis in an attempt to create a portfolio of compelling long and short ideas. Portfolio manager Ali Motamed has been successfully employing this strategy for the last 20+ years.

Learn More

JLL is a leading professional services firm that specializes in real estate and investment management. JLL shapes the future of real estate for a better world by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions for their clients, their people and their communities.

Learn More

Verition seeks to construct a diversified portfolio with low correlation to traditional and alternative asset classes and consistently attractive risk-adjusted returns. Capital is allocated dynamically across the strategies based on the market view and opportunity set for each individual investment team.

Silver Sponsors